Key Takeaways on Amazon Strategy from 2020 OR Snow Show

It was a good turnout at this year’s Outdoor Retailer Snow Show. Industry experts, retailers, and brands gathered in Denver, Colorado to make deals, show off products, and have conversations about the state of the outdoor industry. Amazon was at the forefront of many of those conversations. Speakers and panels provided insight into how brands should integrate the online retail giant with traditional retail channels.

Thinking of Amazon from an Omnichannel Perspective

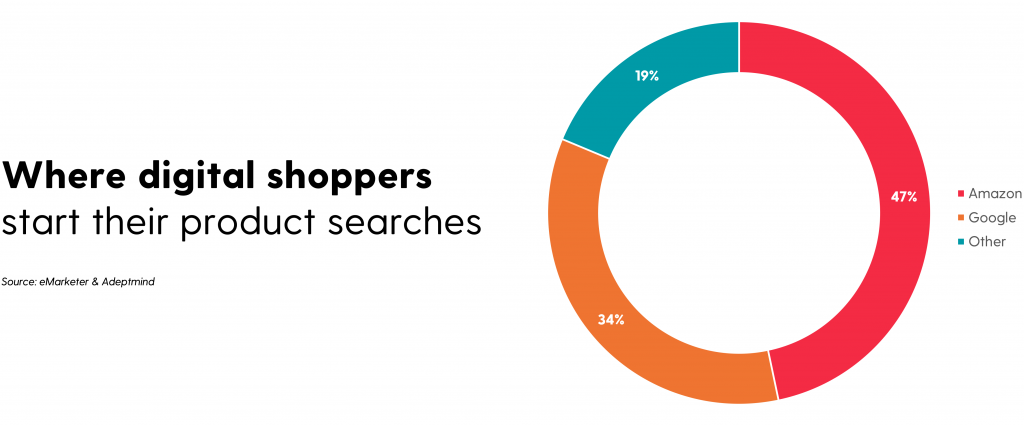

The word “omnichannel” was tossed around a lot at this year’s show. With nearly 50% of US shoppers starting their product searches on the online marketplace, it’s difficult to think about providing a fully-integrated shopping experience without thinking about Amazon. But how and where does it fit? Wildly varying prices and unknown third-party sellers make the online marketplace hard to consolidate with brick and mortar and DTC. For some brands, Amazon may even seem in opposition to the rest of their retail strategy.As a point of purchase, Amazon is heavily focused on delivering convenience. If a shopper can get it cheaper and faster on Amazon, there’s more incentive to buy from the marketplace. This is a pain point for brands and brick and mortar retailers. Without a strong MAP enforcement strategy, it’s easy for unknown sellers to undercut brick and mortar prices online, which can be damaging to retail relationships. Some brands may choose to avoid Amazon for this reason, but the online marketplace isn’t going anywhere. Ignoring Amazon doesn’t work. Taking control is a better answer.GSI Outdoors — Netrush partner and premium camping cookware brand — has firsthand experience with this issue. We caught up with them after the show to hear their perspective on Amazon and how it fits into their omnichannel strategy.

Amazon is a tool that customers use, especially the younger crowd. Even if they aren’t purchasing from the marketplace, they might shop at a physical location, like REI for instance, and research a brand on Amazon at the same time. If you have strong reviews and the price on Amazon matches the retailer, it actually confirms the legitimacy of the item, resulting in a win for both the retailer and the brand. Tom Hathaway, GSI Outdoors North American Director of Sales

Hathaway’s thoughts echoed research performed by Nielsen Global Connected Commerce. Their research found that a majority of customers look into products online before committing to a purchase (both in-store and online). This gets into the idea of “showrooming” and “webrooming.” With showrooming, a shopper gets their hands on a product in-store before making a purchase online. Webrooming is when the opposite occurs, shoppers do their research online and then make their purchase in-store. In both cases, having control over online messaging and pricing matters.Ideally, pricing on the Amazon marketplace will mirror pricing in brick and mortar, even during seasonal promotions. Brands can achieve this control with the right strategies, resources, and hard work. With control, the marketplace can become a tool that bolsters retail sales instead of hurting them. That’s how Amazon starts to fit into an omnichannel strategy, and that was a key message talked about at Snow Show.

Taking Control of Amazon

Effectively placing Amazon in an overall omnichannel retail strategy requires a strong brand protection strategy. Having that protection gives brands the ability to meet customer expectations and deliver a consistent experience through all retail channels.Learn more about taking control by reading our Amazon Brand Protection article.